Payment automation is used by businesses and vendors to make checks, ACH, virtual card payments, and wire transfers to their suppliers as well as to accept payment from clients. The idea is to speed up the payment process all the while minimizing the risk of human error with the help of automation. Read more about payment automation.

It seeks to optimize and automate competencies and procedures that were conventionally performed by humans. Below are the common forms of payment automation:

- Communication touchpoints;

- ACH verification;

- Invoice processing;

- Automatic approvals.

The idea of automated payments began with payable accounts; particularly EDIs — electronic data interchange.

Electronic Invoicing and Data Capture were the first pioneering technologies to disrupt paper checks. Financial automation allows businesses to grow and scale up their payable system for accelerated business growth.

In this post by SPOPLI Web Development & Services talks about why you should set up one such system and how you can do it.

The Mechanism for Setting Up Automatic Payments

The first step in setting up an automatic payment system is to find a service provider.

After that, you can follow these steps to set up an automatic payment to encourage payment from clients and automate business transactions.

Do Your Research

Look into service providers that work with small businesses to automate payments. Pick one that seems to fit with your budget and business model. Most service providers charge a transaction fee for every credit card payment. Therefore, it’s important to look into the fee structure. Make sure that the services include following features.

- Square – Square enables recurring online credit card payments. It also supports online, mobile, and in-store payments

- PayPal – PayPal is an internationally accepted platform for accepting recurring payments as well as online credit card payments. It integrates well with most online payment platforms and in-store purchases.

- Cloud-based accounting – Cloud-based solutions allow your clients to set up automated payments via credit cards at the time of online invoice payment.

Look into Security Features

It’s the foremost responsibility of automated payment service providers to deploy the highest level of encryption and security. This is essential for handling payment information and personal data of clients in a secure manner. But, even then you should perform due diligence and look into specific security measures that your service provider offers.

Market it to Customers

It’s not enough to set up a payment system. Your customers should also know about its availability. That’s when marketing comes into the picture. Let your clients know that they can pay invoices online.

You can mention payment terms on invoices about accepting recurring payments. You can also send emails following each invoice for the initial few months to let customers know about the option of an automated bill payment system so as to make things easier for them.

Below is an example of one such email:

Offer Incentive

As a way of encouragement, you can offer an incentive to any client that signs up for automatic bill payment. You can reward early adopters by offering them a small discount off of the service rendered at the time of invoicing. You can either discount a fixed percentage from the payment or you can deduct a flat amount.

Benefits of Digital Transformation

Automated payments have a lot of benefits to offer. Other than streaming business processes and removing human error, they also make things easier for clients. Take a look at why accepting automatic payments makes sense for businesses regardless of their scale.

Better Cash Flow

With a fixed payment schedule, you can rest assured that the payment will be credited to your account on time. You no longer have to worry about due dates and timely payments. This kind of assurance and easy processing helps to streamline cash flow. It also enables you to plan for your future expenditures and savings.

Makes Things Easier For Clients

Most clients prefer to have a fixed payment schedule which can be weekly or bi-weekly. Automatic payment systems allow clients to set up a schedule once and then forget about it. It gives them assurance and peace of mind that all of their payments will be paid on time without them having to make manual payments.

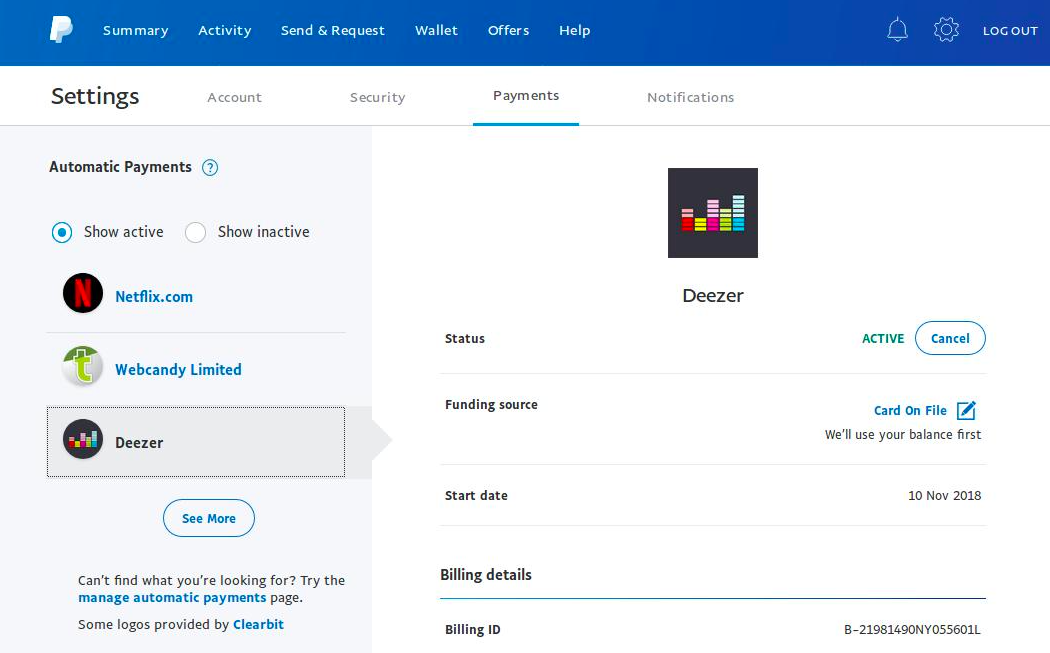

Here’s an example of setting automatic payments in PayPal:

Helps Save Time

Business is all about optimization of processes. The more processes you can automate the more free time you have to think about more important business decisions. Automated payment systems are in line with the exact same philosophy. It allows you to automate all your payments so you don’t have to spend time invoicing each week.

Greater Security

With the help of encryption technologies and high-level payment, an automated system protects the user’s personal data and payment information. It’s a completely secure and safe way to make payments.

Reduced Risk of Fraud

Back in 2015, approx 73% of organizations were victims of payment fraud. Accounting is always at a risk of regulation failure, compliance issues, and fraud. Manual processing of payment adds to the possibility of a security breach. It gets difficult to identify red flags and track issues before they become a bigger problem. This is not the case with automation. It makes room for accuracy, easy tracking, transparency, and accountability across all transactions.

Today it’s easier than ever for companies and businesses to make the switch towards automated payment systems. Digital transformation can make things a lot easier for you. If you still haven’t deployed this system, it’s high time you got into it.