Your sales team is operating as usual: calls are coming in, reps are busy, and the CRM is getting updated. Then the month closes, and the sales leader sees they’re down 15–20% against plan. The default reaction is to look for systemic causes: seasonality, market slowdown, low-quality leads. But sometimes the issue is much more specific — one underperforming rep who drags the entire funnel down. Let’s break down how a Head of Sales can detect a drop in a manager’s performance before it shows up in KPI.

Why KPI is a lagging signal

KPI is the final snapshot of sales performance: plan attainment, number of deals, revenue. It’s the outcome of dozens of small decisions and actions that happened well before the numbers appeared in reports.

When the plan isn’t met, KPI analysis shows leaders not the root cause, but the symptoms:

- conversion rate drops;

- deals stall at different funnel stages;

- revenue declines.

What it doesn’t show is what happened 2–4 weeks earlier:

- how the rep communicated with customers;

- how workload, pace, and productivity changed over time;

- where talk tracks and scripts started to “break.”

Strong Heads of Sales don’t look only at KPI. They monitor early signals in processes and communication that warn them about problems before those problems become visible in the results.

Digital indicators of a weak link

A drop in pace and productivity

A “weak link” rarely looks like someone doing nothing at all. More often, it’s a rep whose work pace becomes inconsistent and unpredictable.

Where should a leader look to spot this?

- the number of outbound calls per day/week compared to the team average;

- the employee’s activity rhythm throughout the day: are there multi-hour “dead zones” with no customer interactions;

- how they handle inbound requests: how quickly they answer calls, and how much time passes between a message or form submission and the first contact.

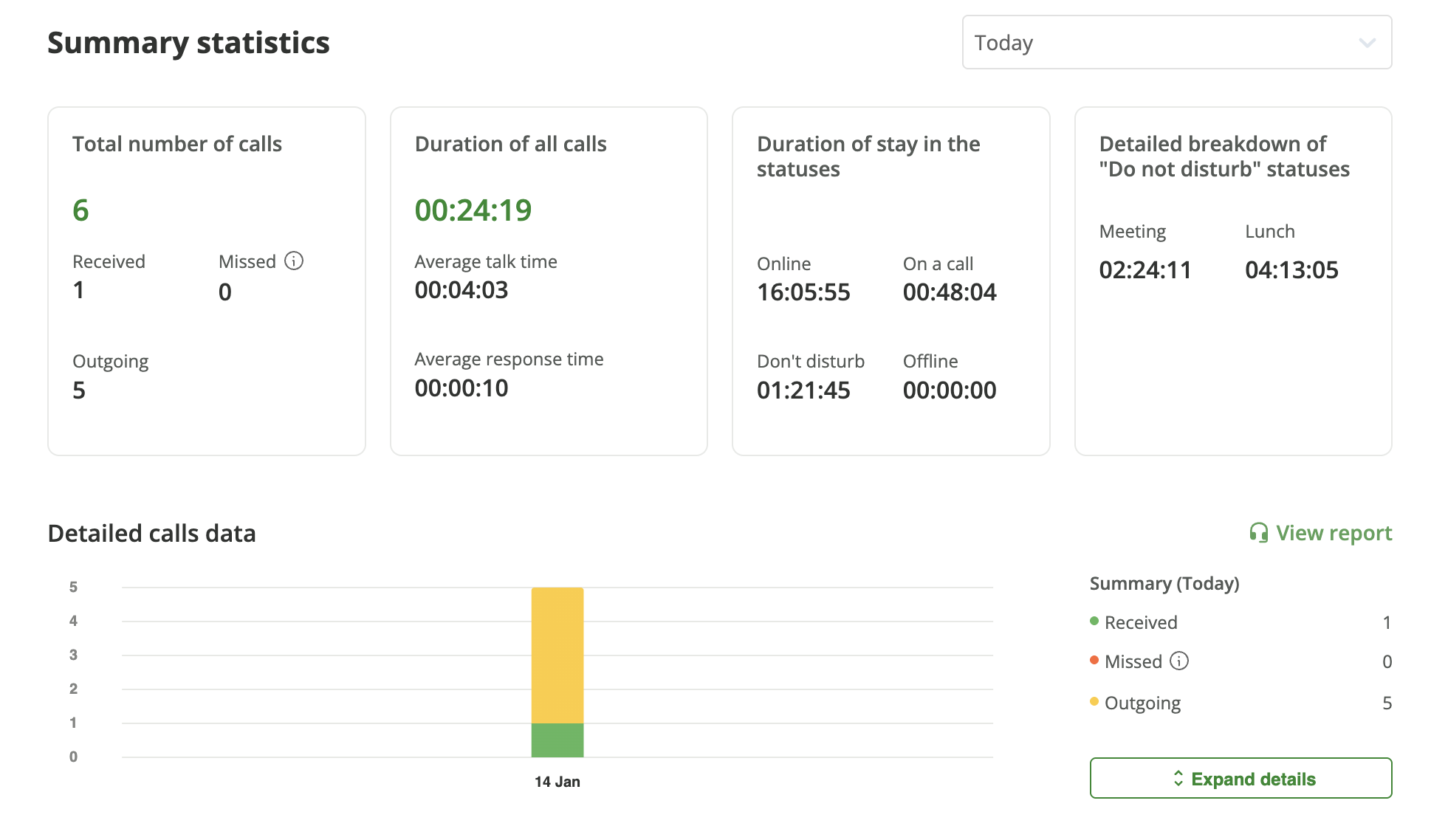

In many companies, these data points have to be pulled manually from different systems. That takes time, so leaders notice the decline only when it hits KPI. It’s no surprise that more Heads of Sales are moving to dashboards that provide a real-time view of activity, where they can observe each rep’s work as it happens. You can immediately see who is actively working leads and who is simply “online.” That makes it possible to intervene early instead of waiting for end-of-month reporting.

Busywork

It happens: a rep appears to be working, but results don’t move. They’re busy, yet the deal isn’t progressing.

Common signals you can spot in call reports include:

- lots of very short calls, such as 10–20 seconds, that never turn into meaningful conversations aligned with the script;

- many repeated call attempts that don’t result in an agreement or a clearly set next step.

Messenger-based work can be busywork too. From the outside, everything looks fine: customers get timely replies, conversations continue. The “weak link” is the rep who writes a lot but doesn’t sell.

In chat, initiative belongs to the person asking the questions. As soon as a rep stops ending messages with a call to action or a suggestion to jump on a call in Telegram/WhatsApp, they become the weak link that drains your budget.

These patterns are easiest to analyze through call and message reports, as well as in the CRM, where call and chat data is automatically synced if integrations are configured. Without manually collecting data or forcing reps to produce additional reports, you can reliably track:

- call frequency and consistency;

- response speed;

- call duration;

- call statuses, including missed, inbound, and outbound;

- repeated attempts to reach customers without outcomes;

- the connection between calls/chats and deal movement through the funnel.

For the Head of Sales at Helsi, call analysis has become a daily management tool. They consistently review:

- daily: operational analytics and missed-call reports to manage workload and avoid losing leads during peak times;

- weekly: rep performance trends — number of calls, new contacts, average duration, and conversation structure;

- monthly: overall call dynamics and rep-to-rep comparisons to keep a steady pulse on the team.

Reports aren’t just statistics. They are practical management tools. They help identify strong and weak reps, maintain discipline, evaluate talk tracks, and make timely decisions about training or process improvements. All of this happens long before performance issues start impacting sales results.

Even with reps working remotely, their performance is fully manageable because telephony and CRM give us clear numbers regardless of where the employee works.

Leads “getting stuck” in the funnel

A sales leader should also pay attention to how a rep moves leads through each funnel stage. Signs of a weak link include:

- “traffic jams” at the top of the funnel: lots of contacts but few transitions to qualified leads, presentations, or proposals;

- leads stalling at a specific stage longer than the team average — for example, everyone reaches the demo stage, but they don’t progress to contract signing;

- suspiciously low conversion between two specific stages, while other stage-to-stage conversions look normal.

In messaging, the problem rarely looks like total lead neglect. More often, it’s the absence of systematic work toward an outcome. Since messengers don’t provide call recordings, your primary control tool becomes chat funnel analytics — specifically, a conversion matrix that shows exactly where leads “dry up.” When you view the matrix by rep, weak links become obvious immediately.

If, after the first customer rejection, a rep does not send 2–3 structured reminders within a week, they sabotage the result.

In messengers, the winner is not the person who writes well, but the one who can follow up at the right time and professionally pull the customer into a voice conversation, where closing the deal is much easier.

Here’s an example of identifying weak links using a table.

Olena. The issue is response speed. In messengers, a lead “cools off” in 10–15 minutes, and the rep simply can’t keep up with inbound traffic tempo.

Dmytro. A classic weak link. He does a lot of chatting (110 conversations) but avoids moving customers to a call (only 8%) and barely does follow-ups (30%). He works only with the “easy wins,” systematically losing up to 70% of potential revenue.

It’s important not to confuse a “bad channel” with a weak salesperson. If other reps perform better with leads from the same source, the issue is most likely the work of a specific person.

Voice indicators: what you can’t see in CRM

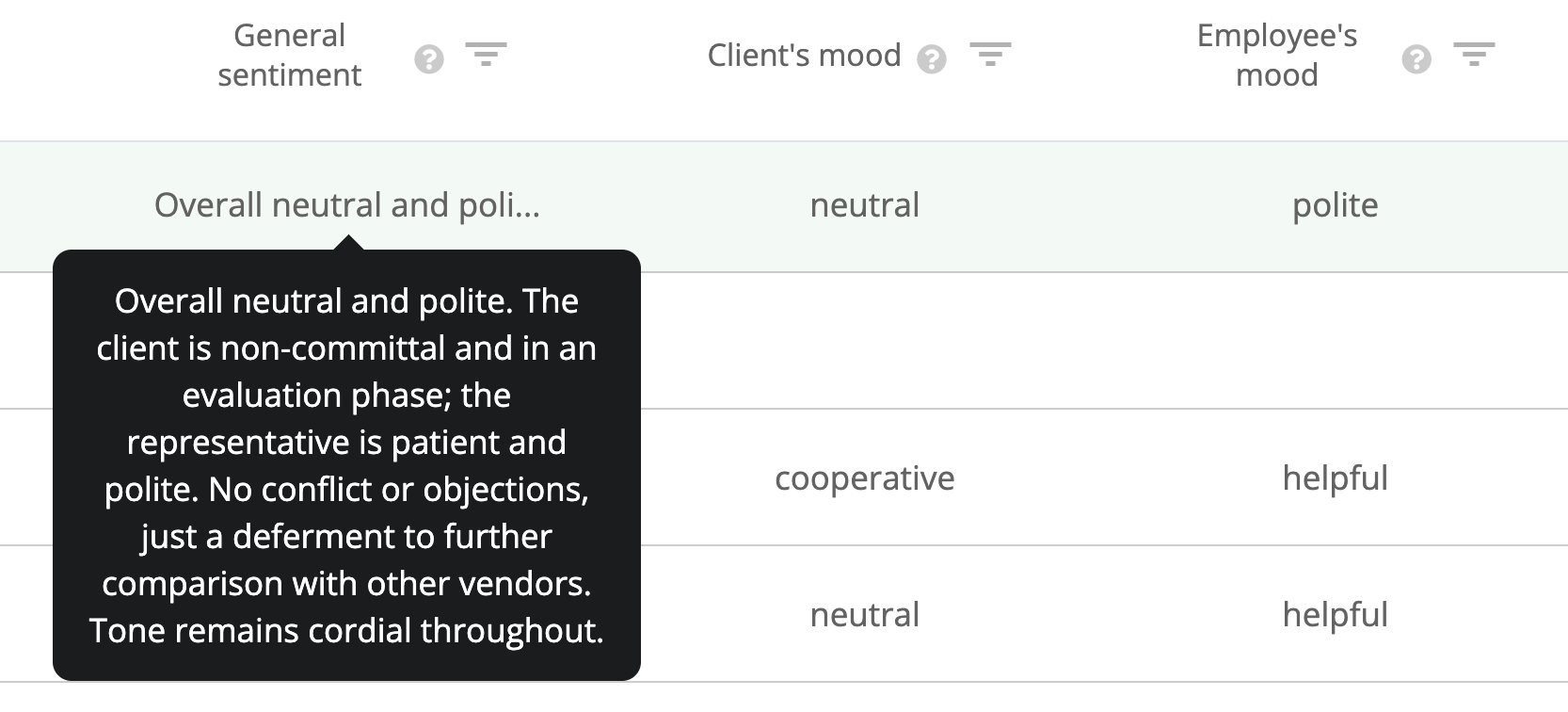

CRM and reports can show when and how much a rep worked. They can’t show the most important part — how the rep actually communicated with customers. Tone, intonation, and emotional cues often reveal a weak link long before it becomes obvious in charts and performance dashboards.

Call recordings are a foundational tool for quality control, team development, and protecting the company’s interests. They provide insights for scripts, training, and handling complex cases.

Speaking pace and rhythm

Overly fast, rushed speech often indicates that the rep is reading a script rather than having a real conversation. The other person doesn’t have time to understand the value proposition, ask questions, or clarify details. On the other hand, a slow, heavy pace reduces trust in the rep’s competence and creates an impression of doubt or fatigue.

Mood

Even a perfectly designed script won’t work if the rep can’t read the customer’s emotional state. A common problem looks like this: the rep does everything “right,” but the conversation never clicks.

Here are a few typical scenarios:

- the rep is friendly, but the customer stays cold and restrained;

- the rep pushes when the customer hesitates or isn’t ready to talk;

- the customer seems confused, but the rep continues the presentation as planned and doesn’t notice the disengagement.

These calls are hard for leaders to spot because they rarely look bad in logs and reports: the call happened, the duration is normal, and the rep is “active.” But tracking these signals manually is difficult. Teams talk every day, and reports quickly accumulate hours of recordings that no one can realistically review.

Even during call reviews, it’s easy to notice the standard elements — greeting, questions, “correct” objection handling, a polite close — yet miss subtle signs of irritation, pressure, or indifference. Meanwhile, this type of communication gradually lowers conversion.

That’s why many companies now use AI call analytics that automatically tracks pace and emotional tone. The system can compare an individual rep’s communication style to the range typically seen in successful calls and flag deviations before they affect overall performance.

Talk-to-listen ratio

A key sign of strong selling is that the customer talks at least as much as the rep. They ask questions, explain context, push back, and express doubts. When the rep dominates the conversation, the dialogue turns into a monologue, and the probability of closing drops sharply.

Objection handling

Objections are one of the most valuable parts of a call. This is when the customer stops being a passive listener and starts voicing real doubts, fears, and misconceptions. If the rep handles this well, the lead moves forward in the funnel. If not, the lead drops off, even after a strong pitch.

Most objections like “too expensive,” “I need to think,” or “not the right time” aren’t refusals. They’re signals. They usually mean, “I don’t see the value,” or “I don’t feel confident about the decision.”

Good objection handling is the ability to:

- hear and understand what the customer actually means when they use standard phrases;

- avoid jumping into arguments and persuasion too quickly;

- ask questions;

- reduce tension instead of escalating it.

A weak link shows up in predictable mistakes: interrupting, arguing, applying pressure, agreeing too quickly, and ending the call after the customer says, “I’ll talk to my spouse.”

AI can help here as well. The tool can automatically find calls and segments where specific triggers appear — “too expensive,” “not the right time,” “I need to think” — and analyze how the rep responds. The Head of Sales doesn’t need to listen to dozens of calls in a row. They can open the exact conversations where something went wrong and make decisions based on the data: training the team, changing scripts, or adjusting processes.

Conversation structure: “jumps” and “gaps”

A well-run call has a recognizable structure: greeting, needs discovery, clarification, offer, and agreement on the next step. If the rep gets confused, skips stages, fails to ask follow-up questions, or doesn’t summarize and set a next step at the end, the call won’t drive results. It may still sound “productive,” but it won’t move the deal forward.

Conversation analytics makes it possible to evaluate calls from a structural standpoint. A leader can define key stages in advance, then use AI reports to see where reps most often lose the thread.

Example

Customers call the manufacturing company ARPAL to understand the technical details of complex equipment. Forget one small but critical detail, and you risk losing the deal. That’s why the company cares not only that a call happened, but also whether reps follow the right structure and logic: greeting, real needs discovery before the pitch, summarizing agreements, and setting the next step.

Early analysis showed that “jumps” between stages, such as rushing into the pitch or failing to close the call clearly, directly reduce conversion. Ringostat’s conversation analytics, used at ARPAL, analyzes all calls and highlights every deviation from the required structure. That enables targeted work on repeated team mistakes long before they start impacting sales results.

A checklist for Heads of Sales

The goal of this checklist is to help a leader spot early signs of trouble before they show up in business-critical sales metrics. Review the items and answer: yes / no / not sure.

Productivity and work rhythm

- Do you know each rep’s stable working pace, not just the team average?

- Do you see sudden drops in call volume without obvious reasons?

- Is the share of short, unfinished calls increasing?

- Can you clearly see who is actively working leads and who is just creating the appearance of activity?

Deal movement and funnel logic

- Do deals move between stages, or do they “hang” in place?

- Do reps set a next step after most interactions?

- Do you have reps with many touches but little progress?

- Do you know at which stage leads are most often lost?

Communication quality

- Do reps’ communication styles differ, and do those differences correlate with results?

- Do some reps’ conversations turn into monologues?

- Do reps ask clarifying questions instead of simply delivering a pitch?

- Do reps adapt the script to each customer’s context?

Voice and mood

- Is speaking pace consistently balanced, without rushing or dragging?

- Do you hear signs of fatigue, irritation, or doubt in reps’ voices?

- Can reps reduce tension when a customer hesitates or disagrees?

- Do reps ignore clear emotional cues in order to “follow the script”?

The bigger picture

- Are all metrics and signals tracked in one place, or does a leader have to manually stitch data together from multiple reports?

- Can you spot deviations in an individual rep’s results compared to overall team performance?

- How quickly can you detect a problem — immediately, within a few days, or only at the end of the month or quarter?

Even if you can’t confidently answer some of these questions, it’s not a management failure. It’s a signal that early indicators still aren’t visible in your operating system.

Conclusion

Identifying a weak link doesn’t require total control. It requires processes that surface risk early, before it turns into a real problem. That means looking not only at your CRM, but also at call analytics, performance reports, and call recordings — especially in tools like Ringostat, where these data points are consolidated in one place.